http://www.gold-eagle.com/article/grandmaster-putins-golden-trap

Very few people understand what Putin is doing at the

moment. And almost no one understands what he will do in the

future.

No matter how strange it may seem, but right now, Putin is

selling Russian oil and gas only for physical gold.

Putin is not shouting about it all over the world. And of course, he

still accepts US dollars as an intermediate means of payment. But

he immediately exchanges all these dollars obtained from the sale of

oil and gas for physical gold!

To understand this, it is enough to look at the dynamics of growth of

gold reserves of Russia and to compare this data with foreign exchange

earnings of the RF coming from the sale of oil and gas over the same

period.

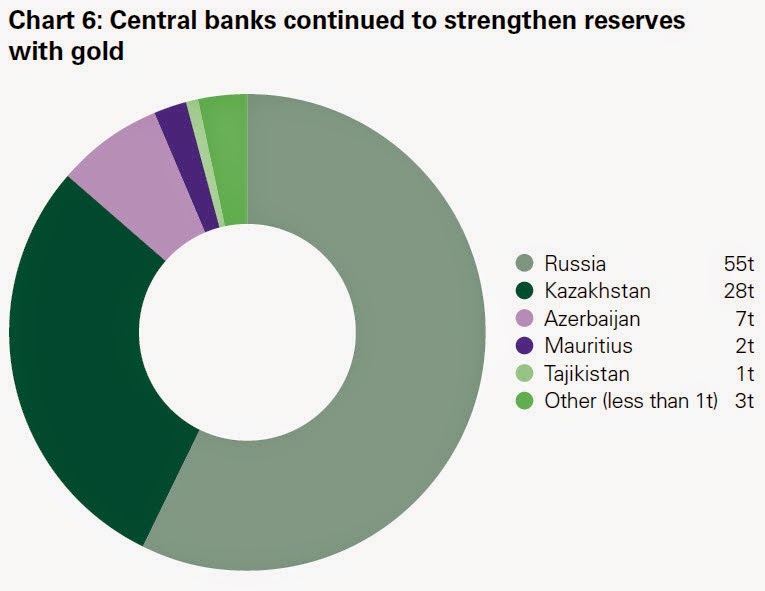

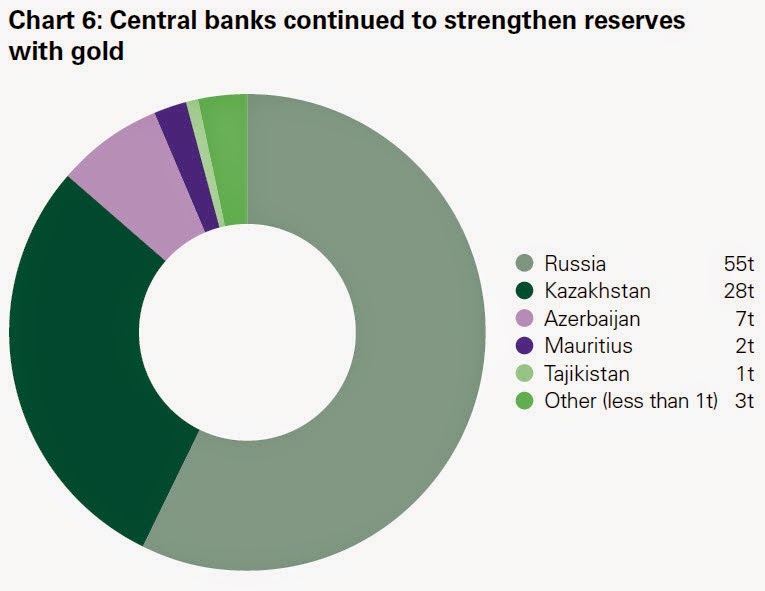

Moreover, in the third quarter the purchases by Russia of physical

gold are at an all-time high, record levels. In the third quarter of

this year, Russia had purchased an incredible amount of gold in the amount

of 55 tons. It’s more than all the central banks of all

countries of the world combined (according to official data)!

In total, the central banks of all countries of the world have purchased

93 tons of the precious metal in the third quarter of 2014. It was the 15th

consecutive quarter of net purchases of gold by Central banks. Of the 93

tonnes of gold purchases by central banks around the world during this

period, the staggering volume of purchases – of 55 tons –

belongs to Russia.

Not so long ago, British scientists have successfully come to the same

conclusion, as was published in the Conclusion of the U.S. Geological

survey a few years ago. Namely: Europe will not be able to survive without

energy supply from Russia. Translated from English to any other language in

the world it means: “The world will not be able to survive if oil

and gas from Russia is subtracted from the global balance of energy

supply”.

Thus, the Western world, built on the hegemony of the petrodollar,

is in a catastrophic situation. In which it cannot survive without oil

and gas supplies from Russia. And Russia is now ready to sell its oil

and gas to the West only in exchange for physical gold! The

twist of Putin’s game is that the mechanism for the

sale of Russian energy to the West only for gold now works

regardless of whether the West agrees to pay for Russian oil and

gas with its artificially cheap gold, or not.

Since Russia has a constant flow of dollars from the sale of oil

and gas, it will be able to convert these dollars to buy gold at current

gold prices, depressed by all means by the West. This equates gold price,

which had been artificially and meticulously lowered by the Fed and

ESF many time...via artificially inflated purchasing power of the dollar

through market manipulation.

Interesting fact: The suppression of gold prices

by the special department of US Government – ESF (Exchange

Stabilization Fund) – with the aim of stabilizing the dollar has been

made into a law in the United States.

In the financial world it is (generally) accepted as a given that gold

is anti-dollar...i.e. the gold price runs inverse to value of the

dollar.

- In 1971, US

President Richard Nixon closed the ‘gold

window’, ending the free exchange of dollars for gold,

guaranteed by the US in 1944 at Bretton Woods.

- In 2014, Russian

President Vladimir Putin has reopened the ‘gold window’,

without asking Washington’s permission.

Right now the West spends much of its efforts and resources to

suppress the prices of gold and oil. Thereby, on the one hand to

distort the existing economic reality in favor of the US dollar ...and on

the other hand, to destroy the Russian economy, refusing to play the role

of obedient vassal of the West.

Today assets such as gold and oil look proportionally weakened and

excessively undervalued against the US dollar. It is a consequence of the

enormous economic effort on the part of the West.

And now Putin sells Russian energy resources in exchange for these US

dollars, artificially propped by the efforts of the West. With these dollar

proceeds Putin immediately buys gold, artificially devalued against

the U.S. dollar by the efforts of the West itself!

There is another interesting element in Putin’s game. It’s Russian

uranium. Every sixth light bulb in the USA depends on its supply,

which Russia sells to the US too...for dollars.

Thus, in exchange for Russian oil, gas and uranium, the West pays Russia

with dollars, purchasing power of which is artificially inflated against

oil and gold by the efforts (manipulations) of the West.

However, Putin uses these dollars only to withdraw physical gold from

the West in exchange at a price denominated in US dollars, artificially lowered by

the same West.

This truly brilliant economic combination

by Putin puts the West led by the United States in a position of a

snake, aggressively and diligently devouring its own tail.

The idea of this economic golden trap for the West is probably not

authored by Putin himself. Most likely it was the idea of Putin’s

Advisor for Economic Affairs – Dr. Sergey Glazyev. Otherwise,

why seemingly not involved in business bureaucrat Glazyev, along

with many Russian businessmen, was personally included by Washington on the

sanction list? The idea of an economist, Dr. Glazyev was

brilliantly executed by Putin...but with full endorsement from his

Chinese colleague – XI Jinping.

Especially interesting in this context looks the November statement of

the first Deputy Chairman of Central Bank of Russia Ksenia Yudaeva, which

stressed that the CBR can use the gold from its reserves to pay for

imports, if need be. It is obvious that in terms of sanctions by the

Western world, this statement is addressed to the BRICS countries,

and first of all China. For China, Russia’s willingness to pay for

goods with Western gold is very convenient. And here’s why:

China recently announced that it will cease to increase its gold

and currency reserves denominated in US dollars. Considering

the growing trade deficit between the US and China (the current difference

is five times in favor of China), then this statement translated from

the financial language reads: “China stops selling their

goods for dollars”. The world’s media chose not to

notice this grandest in the recent monetary historic event . The

issue is not that China literally refuses to sell its goods for US

dollars. China, of course, will continue to accept US dollars as an

intermediate means of payment for its goods. But, having taken dollars,

China will immediately get rid of them and replace with something else

in the structure of its gold and currency reserves. Otherwise the

statement made by the monetary authorities of China loses its

meaning: “We are stopping the increase of our gold and currency

reserves, denominated in US dollars.” That is, China will

no longer buy United States Treasury bonds for dollars

earned from trade with any countries, as they did this before.

Thus, China will replace all the dollars that it will receive for its

goods not only from the US but from all over the world with something

else not to increase their gold currency reserves,

denominated in US dollars. And here is an interesting question: what will

China replace all the trade dollars with? What currency or an

asset? Analysis of the current monetary policy of China shows that

most likely the dollars coming from trade, or a substantial chunk of

them, China will quietly replace and de facto is already replacing

with Gold.

In this aspect, the solitaire of Russian-Chinese relations is extremely

successful for Moscow and Beijing. Russia buys goods from China directly

for gold at its current price. While China buys Russian energy resources

for gold at its current price. At this Russian-Chinese festival of

life there is a place for everything: Chinese goods, Russian energy

resources, and gold – as a means of mutual payment. Only the US

dollar has no place at this festival of life. And this is not

surprising. Because the US dollar is not a Chinese product, nor

a Russian energy resource. It is only an intermediate financial

instrument of settlement – and an unnecessary intermediary. And it is

customary to exclude unnecessary intermediaries from the interaction of two

independent business partners.

It should be noted separately that the global market for physical gold

is extremely small relative to the world market for physical oil supplies.

And especially the world market for physical gold is microscopic

compared to the entirety of world markets for physical delivery of

oil, gas, uranium and goods.

Emphasis on the phrase “physical gold” is made because in exchange for

its physical, not ‘paper’ energy resources, Russia is now withdrawing gold

from the West, but only in its physical, not paper form.

China accomplishes this by acquiring from the West the artificially devalued

physical gold as a payment for physical delivery of real products to

the West.

The West hopes that Russia and China will accept as payment for their

energy resources and goods...the “shitcoin” or so-called “paper gold” of

various kinds also did not materialize. Russia and China are only

interested in real gold and only the physical metal as a final means of

payment.

For reference: the turnover of the market of paper gold, only of gold

futures, is estimated at $360 billion per month. But physical delivery of

gold is only for $280 million a month. This equates to a ratio

of trade of paper gold versus physical gold to 1000 to 1.

Using the mechanism of active withdrawal from the market of one

artificially lowered by the West financial asset (gold) in exchange for

another artificially inflated by the West financial asset (USD), Putin

has thereby started the countdown to the end of the world hegemony of

petrodollar. Thus, Putin has put the West in a deadlock of the absence

of any positive economic prospects.

The West can spend as much of its efforts and resources to

artificially increase the purchasing power of the dollar, lower oil prices

and artificially lower the purchasing power of gold. The problem of

the West is that the stocks of physical gold in possession of the West are

not unlimited. Therefore, the more the West devalues oil and gold against

the US dollar, the faster it loses devaluing Gold from its not infinite

reserves.

In this brilliantly played by Putin economic combination, physical

gold from the reserves of the West is rapidly flowing to Russia, China,

Brazil, Kazakhstan and India (i.e. the BRICS countries). At the

current rate of reduction of reserves of physical gold, the West

simply does not have the time to do anything against Putin’s Russia until

the collapse of the entire Western petrodollar world. In

chess the situation in which Putin has put the West, led by the US, is

called “time trouble”.

The Western world has never faced such economic events and phenomena

that are happening right now. The former USSR rapidly sold gold

during the fall of oil prices. Today, Russia rapidly buys

gold during the fall in oil prices. Thus, Russia poses a real

threat to the American model of petrodollar world domination.

The main principle of world petrodollar model is allowing

Western countries led by the United States to live at the expense of the

labor and resources of other countries...based on the role of the US

currency, dominant in the global monetary system (GMS) . The role of

the US dollar in the GMS is that it is the ultimate means of payment.

This means that the national currency of the United States in the structure

of the GMS is the ultimate asset accumulator, to exchange which to any

other asset does not make sense.

Led by Russia and China, what the BRICS are doing now is actually

changing the role and status of the US dollar in the global monetary

system. From the ultimate means of payment and asset accumulation, the

national currency of the USA, by the joint actions of Moscow and Beijing

is turned into only an intermediate means of payment. Intended

only to exchange this interim payment for another and the

ultimate financial asset – gold. Thus, the US dollar actually loses its

role as the ultimate means of payment and asset accumulation, yielding both

of those roles to another recognized, denationalized and depoliticized

monetary asset – GOLD!

Traditionally, the West has used two methods to eliminate the threat to

the hegemony of petrodollar model in the world and the consequent excessive

privileges for the West:

One of these methods – colored revolutions. The second method, which is

usually applied by the West, if the first fails – military

aggression and bombing.

But in Russia’s case both of these methods are either

impossible or unacceptable for the West.

Because, firstly, the population of Russia, unlike people in many other

countries, does not wish to exchange their freedom and the future of their

children for Western kielbasa (meat sausage). This is evident from the

record ratings of Putin, regularly published by the leading Western

rating agencies. Personal friendship of Washington protégé Navalny with

Senator McCain played for him and Washington a very negative role. Having

learned this fact from the media, 98% of the Russian population now

perceive Navalny only as a vassal of Washington and a traitor to Russia’s

national interests. Therefore Western professionals, who have not yet lost

their mind, cannot dream about any color revolution in Russia.

As for the second traditional Western way of direct military aggression,

Russia is certainly not Yugoslavia, not Iraq nor Libya. In any

non-nuclear military operation against Russia, in the territory of Russia,

the West led by the US is doomed to defeat. And the generals in the

Pentagon exercising real leadership of NATO forces are aware of this.

Similarly hopeless is a nuclear war against Russia, including the concept

of so-called “preventive disarming nuclear strike”. NATO is simply

not technically able to strike a blow that would completely disarm the

nuclear potential of Russia in all its many manifestations. A massive

nuclear retaliatory strike on the enemy or a pool of enemies would be

inevitable. And its total capacity will be enough for survivors to envy

the dead. That is, an exchange of nuclear strikes with a country like

Russia is not a solution to the looming problem of the collapse of a

petrodollar world. It is in the best case, a final chord and the last point

in the history of its existence. In the worst case – a nuclear winter

and the demise of all life on the planet, except for the

bacteria mutated from radiation.

The Western economic establishment can see and understand the essence of

the situation. Leading Western economists are certainly aware of the severity

of the predicament and hopelessness of the situation the Western world

finds itself in, in Putin’s economic gold trap. After all, since the

Bretton Woods agreements, we all know the Golden rule: “Who has

more gold sets the rules.” But everyone in the West is silent

about it. Silent because no one knows now how to get out of this situation.

If you explain to the Western public all the details of the looming

economic disaster, the public will ask the supporters of a petrodollar

world the most horrific questions, which will sound like this:

– How long will the West be able to buy oil and gas

from Russia in exchange for physical gold?

-And what will happen to the US petrodollar after the West runs out

of physical gold to pay for Russian oil, gas and uranium, as

well as to pay for Chinese goods?

No one in the west today can answer these seemingly simple

questions.

And this is called “Checkmate”, ladies and gentlemen. The game

is over.

|

Visit stage3alpha at: http://s3alpha.net/?xg_source=msg_mes_network

To control

which emails you receive on stage3alpha, click here

|

1 comment:

This story is ridiculous when you consider the fact that the US does not buy oil from Russia. Actually, we don't NEED to buy oil from anyone.

Post a Comment