Political Vel Craft

Veil of Politics

Veil of Politics

Installing Of The Obama Mafia: Mel Reynolds Arrested On Porn

Films, Jesse Jackson Jr Thief In Prison, & Those At Large!

February

19, 2014

February

19, 2014  0 Comments

0 Comments

Installing Of The Rothschild Mafia

February

18, 2014

Disgraced Democratic congressman Mel

Reynolds arrested in Zimbabwe after allegedly making 100 porno films and taking

2,000 naked pictures in hotels

- Mel

Reynolds was allegedly in the country illegally since December, making

pornographic films in hotel rooms with at least 10 models

- He

reportedly racked up $24,500 in unpaid hotel bills

- Reynolds

went to prison in the 1990s for the statutory rape of a 16-year-old

campaign volunteer, and for bank fraud

- His

resignation from Congress opened up Barack Obama’s first political

opportunity, when a state senator stepped forward to run for the seat

- Reynolds

claimed Monday that Zimbabwe’s immigration police refused to give him his

passport so he could contact the U.S. Embassy in Harare

- Audacity Of Dumbing Down: Obama

~ ‘Chicago Is an Example of What Makes This Country Great’

- Dismantling Obama’s Agenda:

Bringing To Justice The Corrupted Politicians.

- Jesse Jackson Jr. pleads guilty

to spending $750,000 of campaign funds on self for lavish luxury items.

“James

Carville Predicts Democratic Scandal Streak” beginning

with Obama

inauguration. Saturday, January 3, 2009 10:50 AM

Jackson

Carville

Former Illinois Democratic Rep. Mel Reynolds was arrested

Monday in Zimbabwe after police learned that he was making pornographic films

in hotels where he had accumulated $24,500 in unpaid bills, and that he had

overstayed his visa by two months.

A former Reynolds assistant told the state-controlled newspaper The Herald that the Democratic pol had been paying a model and several other girls to produce his pornos.

‘His travel documents were not up to date and he used to bring beautiful women at different times,’ said the former employee, identified only as Sunny. ‘He employed five of us including a personal assistant and a driver.’

The Herald also reported that Reynolds had made more than 100 sex movies and shot some 1,000 nude photos of at least 10 women. Mere possession of pornographic material is a crime in Zimbabwe.

A former Reynolds assistant told the state-controlled newspaper The Herald that the Democratic pol had been paying a model and several other girls to produce his pornos.

‘His travel documents were not up to date and he used to bring beautiful women at different times,’ said the former employee, identified only as Sunny. ‘He employed five of us including a personal assistant and a driver.’

The Herald also reported that Reynolds had made more than 100 sex movies and shot some 1,000 nude photos of at least 10 women. Mere possession of pornographic material is a crime in Zimbabwe.

A

Zimbabwean immigration official told The Associated Press, Tuesday, Feb. 18,

2014, that Reynolds has been arrested in the African country and is being

investigated. The Herald newspaper reported Tuesday that Reynolds was arrested

for allegedly possessing pornographic material and violating immigration laws.

(AP Photo/M. Spencer Green, File)

Zimbabwean immigration officials say

former Democratic Congressman Mel Reynolds has been arrested for allegedly

possessing pornographic material that he produced, and for violating

immigration laws.

The Bronte Garden Hotel in Harare,

Zimbabwe was the site of Reynolds’ arrest and one of the places where he

allegedly made his smut movies.

Reynolds created a media frenzy in

1995 when he was charged with having sex with an underage campaign worker,

asking her to obtain child pornography for him, and then having her sign false

affidavits recanting the accusations.

Mel Reynolds, once a [London Rothschild] Rhodes scholar and

a close confidante of

Rev. (sic) Jesse Jackson, resigned in disgrace after two years

in Congress when he was convicted of 12 counts of statutory rape, solicitation

of child pornography and obstruction of justice.

- The Sedition Of The British

Cecil Rhodes Scholars (sic).

- 70 Inroads By The British

Rhodes Empire: Monarchy Attempting To Reclaim America By Keynesian Cronie

Capitalism

He was found guilty in 1995 of having sex with a 16-year-old campaign worker. Police ran a sting against the congressman when his mistress, who was too young to vote, told her next-door neighbor about the sexual relationship.

That neighbor was a Chicago police officer.

- Brokeback Obama Rides Again:

Rahm Emanuel Cuddles Back Into Chicago!

- FBI Report: Gun Free Zone

Experiment In Chicago Creates Crisis ~ A Murderer’s Sanctuary Capital In

The United States!

- Video Taping Is Encouraged By

Most U.S. Citizens Employed As police: Federal Court Rules Videoing Police

Protected By U.S. Constitution!

- 86% Of U.S. Police Officers

Stand With Bill Of Rights & Against Gun Control: Police One’s Gun

Control Survey 11 Key Lessons ~ U.S. Police Stand With Their Citizens!

- Obama Signs Two ‘Gun’ Executive

Orders Violating U.S. Laws: Duty To Defy Every Executive Order!

In later taped phone conversations, the teen promised him a

three-way sex romp with a 15-year-old schoolgirl.

‘Did I win the Lotto?’ Reynolds was heard exclaiming on

tape.

While serving a five-year prison sentence, the disgraced Mel

Reynolds was convicted on unrelated bank fraud charges in 1997, including lying

to Securities and Exchange Commission investigators.

He received another six and a half years, but President Bill Clinton later commuted his sentence when he still had three years left to serve.

He received another six and a half years, but President Bill Clinton later commuted his sentence when he still had three years left to serve.

Jesse

Jackson Jr.

Democrat Jesse Jackson Jr., left,

replaced Mel Reynolds in Congress and then

won 88 per cent of the vote when Reynolds challenged him after his release from

prison.

Jesse

Jackson ~ Like Father Like Son.

But Jackson Jr., the son of Rev. Jesse Jackson (R), went to

prison in 2013 for using campaign donations to fund his lavish lifestyle.

Zimbabwe

Harare, Zimbabwe has struggled since

the nation’s currency collapsed in 2008 following an absurd inflation

rate of 230 million per cent.

The country now has no national currency, and is just

beginning to bring in foreign capital, an opportunity Reynolds appears to have

grabbed with a group of hotel investors

Convicted Rapist Mel Reynolds

tried to return to Congress in 2004, losing in a landslide to Jesse Jackson Jr.

– the man who had replaced him in a special election the first time.

Jackson Jr. would go to prison

himself in 2013 for stealing campaign donations to fund a lavish lifestyle.

Jackson, the son of Rev. Jesse Jackson, was a national

co-chair of Barack Obama’s first presidential campaign in 2008.

It was Reynolds’ trysts with the 16-year-old campaign aide that opened up Barack Obama’s first opportunity to enter politics.

It was Reynolds’ trysts with the 16-year-old campaign aide that opened up Barack Obama’s first opportunity to enter politics.

Following the Congressman’s indictment, Illinois state Senator Alice Palmer

leaped forward to challenge him in a Democratic primary. Obama immediately put

his name forward to win the open state legislative post, starting his meteoric

rise to the White House.

A friend from Obama’s community organizing days had been Palmer’s campaign manager, and made an introduction.

A friend from Obama’s community organizing days had been Palmer’s campaign manager, and made an introduction.

It was Alice Palmer who took Obama to the famous meeting in

the Hyde Park home of former Weather Underground terrorist leaders Bill Ayers and Bernardine Dohrn, where Obama launched his

political career.

In 1983, Alice Palmer traveled to Czechoslovakia to the Soviet front World Peace Council’s Prague Assembly. At the time, Alice Palmer was an Executive Board member of the Communist Party USA-dominated U.S. Peace Council.

- Alice Palmer Gulag Bound

In 1983, Alice Palmer traveled to Czechoslovakia to the Soviet front World Peace Council’s Prague Assembly. At the time, Alice Palmer was an Executive Board member of the Communist Party USA-dominated U.S. Peace Council.

- Alice Palmer Gulag Bound

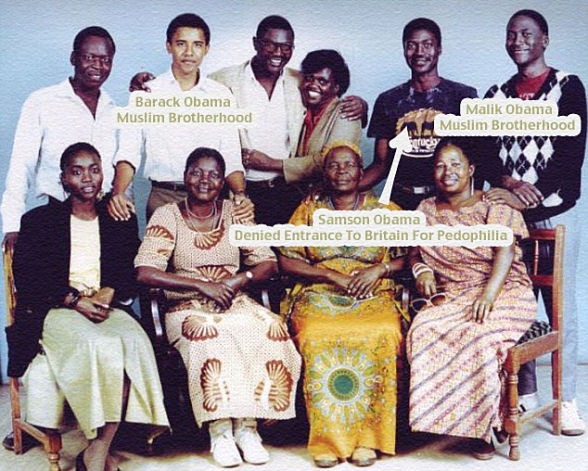

Barack

Obama Jr on his first visit to Kenya in 1987 (Back row L-R): Said Hussein Obama

(brother of Obama sr), Barack Obama Jr, Malik Obama (son of Kezia), unknown

woman, Nyandega (son of Kezia), Otieno (son of Malik) (Seated L-R): Auma

(daughter of Kezia), Kezia (first wife of Obama), Mama Sarah (step-mother to

Obama Sr), Sylpha (sister of Kezia) Robert Crilly collect

- Obama’s Corruption Chronicles

- Kenyan-Born Obama All Set For

US Senate – Sunday June 27, 2004 ‘Sunday Standard’

Small world:

Law professor Barack Obama began his political life when an Illinois state senator left her seat open by running to replace Reynolds after his resignation from Congress

Law professor Barack Obama began his political life when an Illinois state senator left her seat open by running to replace Reynolds after his resignation from Congress

Reynolds complained Monday that the immigration police who

arrested him refused him access to the U.S. Embassy.

‘They denied me my passport so that I can contact the United States Embassy which is a violation of international laws,’ he said.

‘It’s the way it is,’ Reynolds added, defending himself and suggesting that he was the victim of a scheme to embarrass him.

‘I have been in this country 17 times where I have done a lot of work for the people including the fight against sanctions,’ he insisted.

But a source told The Herald that Reynolds had received a 14-day visa on November 13, 2013. He renewed it, said the source, but it expired again on December 10: ‘He has been in the country illegally all along.’

Some of Reynolds work in Zimbabwe includes work as a middle-man for investors who bankrolled a $145 million Hilton hotel and a related office complex that is scheduled to begin construction in April.

‘They denied me my passport so that I can contact the United States Embassy which is a violation of international laws,’ he said.

‘It’s the way it is,’ Reynolds added, defending himself and suggesting that he was the victim of a scheme to embarrass him.

‘I have been in this country 17 times where I have done a lot of work for the people including the fight against sanctions,’ he insisted.

But a source told The Herald that Reynolds had received a 14-day visa on November 13, 2013. He renewed it, said the source, but it expired again on December 10: ‘He has been in the country illegally all along.’

Some of Reynolds work in Zimbabwe includes work as a middle-man for investors who bankrolled a $145 million Hilton hotel and a related office complex that is scheduled to begin construction in April.

- Janet Napolitano Hires $12

Million Supporter Of Hamas ~ Mohamed Elibiary

- Mexican Diplomat: Janet

Napolitano Invited Sinaloa Drug Cartel Across The U.S. Border!

Democrat

California Rep. Lois Capps

Van Jones

- Van Jones Communist

- Obama’s Convicted Race Hustler

Van Jones: The ‘Official Leader’ Of The Banker’s Co-Opted ‘Occupy

Movement’.

Timmy

Geithner The Tax Dodger

- Tim Geithner Oversaw Obama’s $2

Trillion Back Door Bailouts Of Fraud Pumped Stock Markets & Banks For

Inside Traders To Bet Against!

- Reflections On Geithner:

Blocking Special Inspector General On $700 Billion TARP Which Alone Grew

To $12.8 Trillion Debt.

- Why Income Tax Was & Is Not

Necessary To Fund the U.S. General Government.

Corrupt

Charlie Rangel

- Charlie Rangel- Taxpayers

Should Mind Their Own God**** Business

- Obama Surreptitiously Used

Rangel In Attempting To Federalize The Bill Of Right’s State Militias:~

Ethics Panel Found Rangel Guilty on 11 Violations Of House Rules 11/16/2010

CMS

administrator Marilyn Tavenner (left) – HHS Secretary Kathleen Sebelius (right)

- The Sebelius Receives Kickbacks

For Killing Kids.

- The Sebelius In The Footsteps

Of White Supremacist Margaret Sanger: Founder Of Planned Parenthood &

In Court With Shredded Evidence!

Sen. Obama

visits Sylvias Rest. in Harlem wth Rev.Al Sharpton. eating and talking in back

room.

Abedin

Hillary

Christopher

Dodd

Holder

Sitting With ACORN

- ATF, DOJ Accomplice to Murder –

Holder Had Knowledge Of Project Gunrunner In 2009.

- Obama’s Eric Holder Orders

Indictments Halted In U.S. Espionage Case: China Access To Protected U.S.

Space Weapons Technology ~ China Developing Drone Fleet Against U.S –

Report.

Conyers

With Corrupt Wife

- Conyers Wants Civil War Slave

Reparations: But What About The 360,222 Who Gave Their Lives Freeing Them!

- Illinois Congressman John

Conyers’s Wife Accepts Bribes Enslaving Detroit With Corruption. In 2008

She Threatened To Shoot DeDan Milton .

Barney

Frank Housing TSA

Rothschild

Czar Hairy Reed Working Against U.S. Citizens

- Harry Reid’s Aide Traced To

Terrorist Group: Wife Was Paid Money For His Sham Marriage!

- Selling Evil: Anarchist Harry

Reid A Rothschild Czar Calls Constitutional Citizens Anarchists!

DailyMail

DAVID MARTOSKO, U.S. POLITICAL EDITOR

Follow us: @MailOnline on Twitter | DailyMail on Facebook

DAVID MARTOSKO, U.S. POLITICAL EDITOR

Follow us: @MailOnline on Twitter | DailyMail on Facebook

Democrat Scandals

Scandals involving leaders of the

Democrat Party

Overthrown

Rothschild goon Mohamed Morsi of Egypt’s Obama Muslim Brotherhood &

Clinton. Morsi is now in prison in Egypt for murder and inciting violence.

William Jefferson Clinton-

Impeached by the House of Representatives over allegations of perjury and

obstruction of justice, but acquitted by the Senate. Scandals include

Whitewater – Travelgate Gennifer Flowersgate – Filegate – Vince Fostergate –

Whitewater Billing Recordsgate – Paula Jonesgate- Lincoln Bedroomgate –

Donations from Convicted Drug and Weapons Dealersgate – Lippogate – Chinagate –

The Lewinsky Affair – Perjury and Jobs for Lewinskygate – Kathleen Willeygate –

Web Hubbell Prison Phone Callgate – Selling Military Technology to the

Chinesegate – Jaunita Broaddrick Gate – Lootergate – Pardongate

Edward Moore Kennedy - Democrat – U. S. Senator from Massachusetts. Pleaded guilty to leaving the scene of an accident, after his car plunged off a bridge on Chappaquiddick Island killing passenger Mary Jo Kopechne. Deaths Of The Kennedy Family

Edward Moore Kennedy - Democrat – U. S. Senator from Massachusetts. Pleaded guilty to leaving the scene of an accident, after his car plunged off a bridge on Chappaquiddick Island killing passenger Mary Jo Kopechne. Deaths Of The Kennedy Family

Barney

Frank and Herb Moses Of Fannie Mae. Congressman sleeping with an Executive Of

Fannie Mae ~ How Convoluted, How It Smells Of ‘Conflict Of Interest’, How ruse!

Did you know that they were married and divorced?

Did you know that they were married and divorced?

Barney Frank

- Democrat – U.S. Representative from Massachusetts from 1981 to present.

Admitted to having paid Stephen L. Gobie, a male prostitute, for sex and

subsequently hiring Gobie as his personal assistant. Gobie used the

congressman’s Washington apartment for prostitution. A move to expel Frank from

the House of Representatives failed and a motion to censure him failed.

DNC - The Federal Election Commission imposed $719,000 in fines against participants in the 1996 Democratic Party fundraising scandals involving contributions from China, Korea and other foreign sources. The Federal Election Commission said it decided to drop cases against contributors of more than $3 million in illegal DNC contributions because the respondents left the country or the corporations are defunct.

Sandy Berger - Democrat – National Security Advisor during the Clinton Administration. Berger fined $50,000 for illegally removing highly classified documents and handwritten notes from the National Archives during preparations for the Sept. 11 commission hearings.

Robert Torricelli - Democrat – Withdrew from the 2002 Senate race with less than 30 days before the election because of controversy over personal gifts he took from a major campaign donor and questions about campaign donations from 1996.

James McGreevey - Democrat – New Jersey Governor . Admitted to having a gay affair. Resigned after allegations of sexual harassment, rumors of being blackmailed on top of fundraising investigations and indictments.

Jesse Jackson - Democrat – Democratic candidate for President. Admitted to having an extramarital affair and fathering a illegitimate child.

Gary Condit - Democrat – US Democratic Congressman from California. Condit had an affair with an intern. Condit, covered up the affair and lied to police after she went missing. No charges were ever filed against Condit. Her remains were discovered in a Washington DC park..

Eliot Spitzer- Democrat – New York governor – resigned from office after being tied to a prostitution ring.

Sowande Ajumoke Omokunde - Democrat – the son of newly elected U.S. Rep. Gwen Moore, was booked on charges of criminal damage to property for allegedly slashing tires on 20 vans and cars rented by the Republican Party for use in Election Day voter turnout efforts.

Daniel David Rostenkowski - Democrat – U.S. Representative from Illinois from 1959 to 1995. Indicted on 17 felony charges- pleaded guilty to two counts of misuse of public funds and sentenced to seventeen months in federal prison.

DNC - The Federal Election Commission imposed $719,000 in fines against participants in the 1996 Democratic Party fundraising scandals involving contributions from China, Korea and other foreign sources. The Federal Election Commission said it decided to drop cases against contributors of more than $3 million in illegal DNC contributions because the respondents left the country or the corporations are defunct.

Sandy Berger - Democrat – National Security Advisor during the Clinton Administration. Berger fined $50,000 for illegally removing highly classified documents and handwritten notes from the National Archives during preparations for the Sept. 11 commission hearings.

Robert Torricelli - Democrat – Withdrew from the 2002 Senate race with less than 30 days before the election because of controversy over personal gifts he took from a major campaign donor and questions about campaign donations from 1996.

James McGreevey - Democrat – New Jersey Governor . Admitted to having a gay affair. Resigned after allegations of sexual harassment, rumors of being blackmailed on top of fundraising investigations and indictments.

Jesse Jackson - Democrat – Democratic candidate for President. Admitted to having an extramarital affair and fathering a illegitimate child.

Gary Condit - Democrat – US Democratic Congressman from California. Condit had an affair with an intern. Condit, covered up the affair and lied to police after she went missing. No charges were ever filed against Condit. Her remains were discovered in a Washington DC park..

Eliot Spitzer- Democrat – New York governor – resigned from office after being tied to a prostitution ring.

Sowande Ajumoke Omokunde - Democrat – the son of newly elected U.S. Rep. Gwen Moore, was booked on charges of criminal damage to property for allegedly slashing tires on 20 vans and cars rented by the Republican Party for use in Election Day voter turnout efforts.

Daniel David Rostenkowski - Democrat – U.S. Representative from Illinois from 1959 to 1995. Indicted on 17 felony charges- pleaded guilty to two counts of misuse of public funds and sentenced to seventeen months in federal prison.

FILE – In

this Nov. 28, 2012, file photo, former U.S. Rep. Melvin Reynolds announces that

he’s joining the increasingly crowded field running for the 2nd District seat

vacated by Jesse Jackson Jr. This after his conviction for rape.

Melvin Jay Reynolds - Democrat

U.S. Representative from Illinois from 1993 to 1995. Convicted on sexual

misconduct and obstruction of justice charges and sentenced to five years in

prison.

Wayne Bryant - Democrat NJ state senator- was convicted was found guilty on all 12 counts against him including bribery and pension fraud.

Charles Coles Diggs, Jr. - Democrat – U.S. Representative from Michigan from 1955 to 1980. Convicted on eleven counts of mail fraud and filing false payroll forms- sentenced to three years in prison.

George Rogers - Democrat – Massachusetts State House of Representatives from 1965 to 1970. M000ember of Massachusetts State Senate from 1975 to 1978. Convicted of bribery in 1978 and sentenced to two years in prison.

Don Siegelman - Democrat Governor Alabama – indicted in a bid-rigging scheme involving a maternity-care program. The charges accused Siegelman and his former chief of staff of helping Tuscaloosa physician Phillip Bobo rig bids. Siegelman was accused of moving $550,000 from the state education budget to the State Fire College in Tuscaloosa so Bobo could use the money to pay off a competitor for a state contract for maternity care.

John Murtha, Jr. - Democrat – U.S. Representative from Pennsylvania. Implicated in the Abscam sting, in which FBI agents impersonating Arab businessmen offered bribes to political figures; Murtha was cited as an unindicted co-conspirator.

Otto Kerner - Democrat governor of Illinois from 1961 to 1968 was jailed after the manager of two horse-racing tracks admitted to bribing the then- governor; charges were filed after Kerner left office he was convicted in 1973.

Dan Walker - Democrat governor of Illinois from1973 to 1977 served less than two years of a seven-year sentence for receiving improper loans a decade after leaving office.

Gerry Eastman Studds - Democrat – U.S. Representative from Massachusetts from 1973 to 1997. The first openly gay member of Congress. Censured by the House of Representatives for having sexual relations with a teenage House page.

Hiram Monserrate- Queens City Councilman and state Senator-elect – who has claimed to be an advocate of victims of domestic violence – was arrested for breaking a glass over his girlfriend’s face. Monserrate, 41, a former cop, won election to the state Senate as a Democrat in November 2008.

James C. Green - Democrat – North Carolina State House of Representatives from 1961 to 1977. Charged with accepting a bribe from an undercover FBI agent, but was acquitted. Convicted of tax evasion in 1997.

Frederick Richmond - Democrat – U.S. Representative from New York from 1975 to 1982. Arrested in Washington, D.C., in 1978 for soliciting sex from a minor and from an undercover police officer – pleaded guilty to a misdemeanor. Also – charged with tax evasion, marijuana possession, and improper payments to a federal employee – pleaded guilty.

Raymond Lederer - Democrat – U.S. Representative from Pennsylvania from 1977 to 1981. Implicated in the Abscam sting – convicted of bribery and sentenced to three years in prison and fined $20,000.

Harrison Arlington Williams, Jr. - Democrat – U.S. Senator from New Jersey from 1959 to 1970. Implicated in the Abscam sting. Allegedly accepted an 18% interest in a titanium mine. Convicted of nine counts of bribery, conspiracy, receiving an unlawful gratuity, conflict of interest, and interstate travel in aid of racketeering. Sentenced to three years in prison and fined $50,000.

Frank Thompson, Jr. – Democrat – U.S. Representative from New Jersey from 1955 to 1980. Implicated in the Abscam sting, convicted on bribery and conspiracy charges. Sentenced to three years in prison

Michael Joseph Myers - Democrat – U.S. Representative from Pennsylvania from 1976 to 1980. Implicated in the Abscam sting – convicted of bribery and conspiracy; sentenced to three years in prison and fined $20,000; expelled from the House of Representatives on October 2, 1980.

John Michael Murphy - Democrat – U.S. Representative from New York from 1963 to 1981. Implicated in the Abscam sting. Convicted of conspiracy, conflict of interest, and accepting an illegal gratuity. Sentenced to three years in prison and fined $20,000.

John Wilson Jenrette, Jr - Democrat – U.S. Representative from South Carolina from 1975 to 1980. Implicated in the Abscam sting. Convicted on bribery and conspiracy charges and sentenced to prison

Neil Goldschmidt - Democrat – Oregon governor. Admitted to having an illegal sexual relationship with a 14-year-old teenager while he was serving as Mayor of Portland.

Alcee Lamar Hastings - Democrat – U.S. Representative from Florida. Impeached and removed from office as federal judge in 1989 over bribery charges.

Marion Barry - Democrat – mayor of Washington, D.C., from 1979 to 1991 and again from 1995 to 1999. Convicted of cocaine possession after being caught on videotape smoking crack cocaine. Sentenced to six months in prison.

Mario Biaggi - Democrat – U.S. Representative from New York from 1969 to 1988. Indicted on federal charges that he had accepted bribes in return for influence on federal contracts.Convicted of obstructing justice and accepting illegal gratuities. Tried in 1988 on federal racketeering charges and convicted on 15 felony counts.

Lee Alexander - Democrat – Mayor of Syracuse, N.Y. from 1970 to 1985. Was indicted over a $1.5 million kickback scandal. Pleaded guilty to racketeering and tax evasion charges. Served six years in prison.

Bill Campbell - Democrat – Mayor of Atlanta. Indicted and charged with fraud over claims he accepted improper payments from contractors seeking city contracts.

Frank Ballance - Democrat – Congressman North Carolina. Pleaded guilty to one charge of conspiracy to commit mail fraud and money laundering related to mishandling of money by his charitable foundation.

Hazel O’Leary - Democrat – Secretary of Energy during the Clinton Administration – O’leary took trips all over the world as Secretary with as many 50 staff members and at times rented a plane, which was used by Madonna during her concert tours.

Lafayette Thomas - Democrat – Candidate for Tennessee State House of Representatives in 1954. Sheriff of Davidson County, from 1972 to 1990. Indicted in federal court on 54 counts of abusing his power as sheriff. Pleaded guilty to theft and mail fraud; sentenced to five years in prison.

Mary Rose Oakar - Democrat – U.S. Representative from Ohio from 1977 to 1993. Pleaded guilty to two misdemeanor charges of funneling $16,000 through fake donors.

David Giles - Democrat – candidate for U.S. Representative from Washington in 1986 and 1990. Convicted in June 2000 of child rape.

Gary Siplin - Democrat state senator Florida- found guilty of third-degree grand theft of $5,000 or more, a felony, and using services of employees for his candidacy.

Edward Mezvinsky - Democrat - U.S. Representative from Iowa from 1973 to 1977. Indicted on 56 federal fraud charges.

Lena Swanson - Democrat - Member of Washington State Senate in 1997. Pleaded guilty to charges of soliciting unlawful payments from veterans and former prisoners of war.

Abraham J. Hirschfeld - Democrat – candidate in Democratic primary for U.S. Senator from New York in 1974 and 1976. Offered Paula Jones $1 million to drop her sexual harassment lawsuit against President Bill Clinton. Convicted in 2000 of trying to hire a hit man to kill his business partner.

Henry Cisneros - Democrat – U.S. Secretary of Housing and Urban Development from 1993 to 1997. Pleaded guilty to a misdemeanor charge of lying to the FBI.

James A. Traficant Jr. – Member of House of Representatives from Ohio. Expelled from Congress after being convicted of corruption charges. Sentenced today to eight years in prison for accepting bribes and kickbacks.

John Doug Hays - Democrat – member of Kentucky State Senate from 1980 to 1982 Found guilty of mail fraud for submitting false campaign reports stemming from an unsuccessful run for judge. He was sentenced to six months in prison to be followed by six months of home confinement and three years of probation.

Henry J. Cianfrani - Democrat - Pennsylvania State Senate from 1967 to 1976. Convicted on federal charges of racketeering and mail fraud for padding his Senate payroll. Sentenced to five years in federal prison.

David Hall - Democrat – Governor of Oklahoma from 1971 to 1975. Indicted on extortion and conspiracy charges. Convicted and sentenced to three years in prison.

John A. Celona - Democrat – A former state senator was charged with the three counts of mail fraud. Federal prosecutors accused him of defrauding the state and collecting hundreds of thousands of dollars from CVS Corp. and others while serving in the legislature. Celona has agreed to plead guilty to taking money from the CVS pharmacy chain and other companies that had interest in legislation. Under the deal, Celona agreed to cooperate with investigators. He faces up to five years in federal prison on each of the three counts and a $250,000 fine

Allan Turner Howe - Democrat – U.S. Representative from Utah from 1975 to 1977. Arrested for soliciting a policewoman posing as a prostitute.

Jerry Cosentino - Democrat – Illinois State Treasurer. Pleaded guilty to bank fraud – fined $5,000 and sentenced to nine months home confinement.

Joseph Waggonner Jr. - Democrat – U.S. Representative from Louisiana from 1961 to 19 79. Arrested in Washington, D.C. for soliciting a policewoman posing as a prostitute

Albert G. Bustamante - Democrat – U.S. Representative from Texas from 1985 to 1993. Convicted in 1993 on racketeering and bribery charges and sentenced to prison.

Lawrence Jack Smith - Democrat – U.S. Representative from Florida from 1983 to 1993. Sentenced to three months in federal prison for tax evasion.

David Lee Walters - Democrat – Governor of Oklahoma from 1991 to 1995. Pleaded guilty to a misdemeanor election law violation.

James Guy Tucker, Jr. - Democrat – Governor of Arkansas from 1992 to 1996. Resigned in July 1996 after conviction on federal fraud charges as part of the Whitewater investigation.

Walter Rayford Tucker - Democrat – Mayor of Compton, California from 1991 to 1992; U.S. Representative from California from 1993 to 1995. Sentenced to 27 months in prison for extortion and tax evasion.

William McCuen - Democrat – Secretary of State of Arkansas from 1985 to 1995. Admitted accepting kickbacks from two supporters he gave jobs, and not paying taxes on the money. Admitted to conspiring with a political consultant to split $53,560 embezzled from the state in a sham transaction. He was indicted on corruption charges. Pleaded guilty to felony counts tax evasion and accepting a kickback. Sentenced to 17 years in prison.

Walter Fauntroy - Democrat – Delegate to U.S. Congress from the District of Columbia from 1971 to 1991. Charged in federal court with making false statements on financial disclosure forms. Pleaded guilty to one felony count and sentenced to probation.

Carroll Hubbard, Jr. - Democrat – Kentucky State Senate from 1968 to 1975 and U.S. Representative from Kentucky from 1975 to 1993. Pleaded guilty to conspiring to defraud the Federal Elections Commission and to theft of government property; sentenced to three years in prison.

Joseph Kolter - Democrat – member of Pennsylvania State House of Representatives from 1969 to 1982 and U.S. Representative from Pennsylvania from 1983 to 1993. Indicted by a Federal grand jury on five felony charges of embezzlement at the U.S. House post office. Pleaded guilty.

Webster Hubbell - Democrat – Chief Justice of Arkansas State Supreme Court in 1983. Pleaded guilty to federal mail fraud and tax evasion charges – sentenced to 21 months in prison.

Nicholas Mavroules - Democrat – U.S. Representative from Massachusetts from 1979 to 1993. Pleaded guilty to charges of tax fraud and accepting gratuities while in office.

Carl Christopher Perkins - Democrat – Kentucky State House of Representatives from 1981 to 1984 and U.S. Representative from Kentucky from 1985 to 1993. Pleaded guilty to bank fraud in connection with the House banking scandal. Perkins wrote overdrafts totaling about $300,000. Pleaded guilty to charges of filing false statements with the Federal Election Commission and false financial disclosure reports. Sentenced to 21 months in prison.

Richard Hanna - Democrat – U.S. Representative from California from 1963 to 1974. Received payments of about $200,000 from a Korean businessman in what became known as the “Koreagate” influence buying scandal. Pleaded guilty and sentenced to federal prison.

Angelo Errichetti - Democrat – New Jersey State Senator was sentenced to six years in prison and fined $40,000 for his involvement in Abscam.

Daniel Baugh Brewster - Democrat – U.S. Senator from Maryland. Indicted on charges of accepting illegal gratuity while in Senate.

Wayne Bryant - Democrat NJ state senator- was convicted was found guilty on all 12 counts against him including bribery and pension fraud.

Charles Coles Diggs, Jr. - Democrat – U.S. Representative from Michigan from 1955 to 1980. Convicted on eleven counts of mail fraud and filing false payroll forms- sentenced to three years in prison.

George Rogers - Democrat – Massachusetts State House of Representatives from 1965 to 1970. M000ember of Massachusetts State Senate from 1975 to 1978. Convicted of bribery in 1978 and sentenced to two years in prison.

Don Siegelman - Democrat Governor Alabama – indicted in a bid-rigging scheme involving a maternity-care program. The charges accused Siegelman and his former chief of staff of helping Tuscaloosa physician Phillip Bobo rig bids. Siegelman was accused of moving $550,000 from the state education budget to the State Fire College in Tuscaloosa so Bobo could use the money to pay off a competitor for a state contract for maternity care.

John Murtha, Jr. - Democrat – U.S. Representative from Pennsylvania. Implicated in the Abscam sting, in which FBI agents impersonating Arab businessmen offered bribes to political figures; Murtha was cited as an unindicted co-conspirator.

Otto Kerner - Democrat governor of Illinois from 1961 to 1968 was jailed after the manager of two horse-racing tracks admitted to bribing the then- governor; charges were filed after Kerner left office he was convicted in 1973.

Dan Walker - Democrat governor of Illinois from1973 to 1977 served less than two years of a seven-year sentence for receiving improper loans a decade after leaving office.

Gerry Eastman Studds - Democrat – U.S. Representative from Massachusetts from 1973 to 1997. The first openly gay member of Congress. Censured by the House of Representatives for having sexual relations with a teenage House page.

Hiram Monserrate- Queens City Councilman and state Senator-elect – who has claimed to be an advocate of victims of domestic violence – was arrested for breaking a glass over his girlfriend’s face. Monserrate, 41, a former cop, won election to the state Senate as a Democrat in November 2008.

James C. Green - Democrat – North Carolina State House of Representatives from 1961 to 1977. Charged with accepting a bribe from an undercover FBI agent, but was acquitted. Convicted of tax evasion in 1997.

Frederick Richmond - Democrat – U.S. Representative from New York from 1975 to 1982. Arrested in Washington, D.C., in 1978 for soliciting sex from a minor and from an undercover police officer – pleaded guilty to a misdemeanor. Also – charged with tax evasion, marijuana possession, and improper payments to a federal employee – pleaded guilty.

Raymond Lederer - Democrat – U.S. Representative from Pennsylvania from 1977 to 1981. Implicated in the Abscam sting – convicted of bribery and sentenced to three years in prison and fined $20,000.

Harrison Arlington Williams, Jr. - Democrat – U.S. Senator from New Jersey from 1959 to 1970. Implicated in the Abscam sting. Allegedly accepted an 18% interest in a titanium mine. Convicted of nine counts of bribery, conspiracy, receiving an unlawful gratuity, conflict of interest, and interstate travel in aid of racketeering. Sentenced to three years in prison and fined $50,000.

Frank Thompson, Jr. – Democrat – U.S. Representative from New Jersey from 1955 to 1980. Implicated in the Abscam sting, convicted on bribery and conspiracy charges. Sentenced to three years in prison

Michael Joseph Myers - Democrat – U.S. Representative from Pennsylvania from 1976 to 1980. Implicated in the Abscam sting – convicted of bribery and conspiracy; sentenced to three years in prison and fined $20,000; expelled from the House of Representatives on October 2, 1980.

John Michael Murphy - Democrat – U.S. Representative from New York from 1963 to 1981. Implicated in the Abscam sting. Convicted of conspiracy, conflict of interest, and accepting an illegal gratuity. Sentenced to three years in prison and fined $20,000.

John Wilson Jenrette, Jr - Democrat – U.S. Representative from South Carolina from 1975 to 1980. Implicated in the Abscam sting. Convicted on bribery and conspiracy charges and sentenced to prison

Neil Goldschmidt - Democrat – Oregon governor. Admitted to having an illegal sexual relationship with a 14-year-old teenager while he was serving as Mayor of Portland.

Alcee Lamar Hastings - Democrat – U.S. Representative from Florida. Impeached and removed from office as federal judge in 1989 over bribery charges.

Marion Barry - Democrat – mayor of Washington, D.C., from 1979 to 1991 and again from 1995 to 1999. Convicted of cocaine possession after being caught on videotape smoking crack cocaine. Sentenced to six months in prison.

Mario Biaggi - Democrat – U.S. Representative from New York from 1969 to 1988. Indicted on federal charges that he had accepted bribes in return for influence on federal contracts.Convicted of obstructing justice and accepting illegal gratuities. Tried in 1988 on federal racketeering charges and convicted on 15 felony counts.

Lee Alexander - Democrat – Mayor of Syracuse, N.Y. from 1970 to 1985. Was indicted over a $1.5 million kickback scandal. Pleaded guilty to racketeering and tax evasion charges. Served six years in prison.

Bill Campbell - Democrat – Mayor of Atlanta. Indicted and charged with fraud over claims he accepted improper payments from contractors seeking city contracts.

Frank Ballance - Democrat – Congressman North Carolina. Pleaded guilty to one charge of conspiracy to commit mail fraud and money laundering related to mishandling of money by his charitable foundation.

Hazel O’Leary - Democrat – Secretary of Energy during the Clinton Administration – O’leary took trips all over the world as Secretary with as many 50 staff members and at times rented a plane, which was used by Madonna during her concert tours.

Lafayette Thomas - Democrat – Candidate for Tennessee State House of Representatives in 1954. Sheriff of Davidson County, from 1972 to 1990. Indicted in federal court on 54 counts of abusing his power as sheriff. Pleaded guilty to theft and mail fraud; sentenced to five years in prison.

Mary Rose Oakar - Democrat – U.S. Representative from Ohio from 1977 to 1993. Pleaded guilty to two misdemeanor charges of funneling $16,000 through fake donors.

David Giles - Democrat – candidate for U.S. Representative from Washington in 1986 and 1990. Convicted in June 2000 of child rape.

Gary Siplin - Democrat state senator Florida- found guilty of third-degree grand theft of $5,000 or more, a felony, and using services of employees for his candidacy.

Edward Mezvinsky - Democrat - U.S. Representative from Iowa from 1973 to 1977. Indicted on 56 federal fraud charges.

Lena Swanson - Democrat - Member of Washington State Senate in 1997. Pleaded guilty to charges of soliciting unlawful payments from veterans and former prisoners of war.

Abraham J. Hirschfeld - Democrat – candidate in Democratic primary for U.S. Senator from New York in 1974 and 1976. Offered Paula Jones $1 million to drop her sexual harassment lawsuit against President Bill Clinton. Convicted in 2000 of trying to hire a hit man to kill his business partner.

Henry Cisneros - Democrat – U.S. Secretary of Housing and Urban Development from 1993 to 1997. Pleaded guilty to a misdemeanor charge of lying to the FBI.

James A. Traficant Jr. – Member of House of Representatives from Ohio. Expelled from Congress after being convicted of corruption charges. Sentenced today to eight years in prison for accepting bribes and kickbacks.

John Doug Hays - Democrat – member of Kentucky State Senate from 1980 to 1982 Found guilty of mail fraud for submitting false campaign reports stemming from an unsuccessful run for judge. He was sentenced to six months in prison to be followed by six months of home confinement and three years of probation.

Henry J. Cianfrani - Democrat - Pennsylvania State Senate from 1967 to 1976. Convicted on federal charges of racketeering and mail fraud for padding his Senate payroll. Sentenced to five years in federal prison.

David Hall - Democrat – Governor of Oklahoma from 1971 to 1975. Indicted on extortion and conspiracy charges. Convicted and sentenced to three years in prison.

John A. Celona - Democrat – A former state senator was charged with the three counts of mail fraud. Federal prosecutors accused him of defrauding the state and collecting hundreds of thousands of dollars from CVS Corp. and others while serving in the legislature. Celona has agreed to plead guilty to taking money from the CVS pharmacy chain and other companies that had interest in legislation. Under the deal, Celona agreed to cooperate with investigators. He faces up to five years in federal prison on each of the three counts and a $250,000 fine

Allan Turner Howe - Democrat – U.S. Representative from Utah from 1975 to 1977. Arrested for soliciting a policewoman posing as a prostitute.

Jerry Cosentino - Democrat – Illinois State Treasurer. Pleaded guilty to bank fraud – fined $5,000 and sentenced to nine months home confinement.

Joseph Waggonner Jr. - Democrat – U.S. Representative from Louisiana from 1961 to 19 79. Arrested in Washington, D.C. for soliciting a policewoman posing as a prostitute

Albert G. Bustamante - Democrat – U.S. Representative from Texas from 1985 to 1993. Convicted in 1993 on racketeering and bribery charges and sentenced to prison.

Lawrence Jack Smith - Democrat – U.S. Representative from Florida from 1983 to 1993. Sentenced to three months in federal prison for tax evasion.

David Lee Walters - Democrat – Governor of Oklahoma from 1991 to 1995. Pleaded guilty to a misdemeanor election law violation.

James Guy Tucker, Jr. - Democrat – Governor of Arkansas from 1992 to 1996. Resigned in July 1996 after conviction on federal fraud charges as part of the Whitewater investigation.

Walter Rayford Tucker - Democrat – Mayor of Compton, California from 1991 to 1992; U.S. Representative from California from 1993 to 1995. Sentenced to 27 months in prison for extortion and tax evasion.

William McCuen - Democrat – Secretary of State of Arkansas from 1985 to 1995. Admitted accepting kickbacks from two supporters he gave jobs, and not paying taxes on the money. Admitted to conspiring with a political consultant to split $53,560 embezzled from the state in a sham transaction. He was indicted on corruption charges. Pleaded guilty to felony counts tax evasion and accepting a kickback. Sentenced to 17 years in prison.

Walter Fauntroy - Democrat – Delegate to U.S. Congress from the District of Columbia from 1971 to 1991. Charged in federal court with making false statements on financial disclosure forms. Pleaded guilty to one felony count and sentenced to probation.

Carroll Hubbard, Jr. - Democrat – Kentucky State Senate from 1968 to 1975 and U.S. Representative from Kentucky from 1975 to 1993. Pleaded guilty to conspiring to defraud the Federal Elections Commission and to theft of government property; sentenced to three years in prison.

Joseph Kolter - Democrat – member of Pennsylvania State House of Representatives from 1969 to 1982 and U.S. Representative from Pennsylvania from 1983 to 1993. Indicted by a Federal grand jury on five felony charges of embezzlement at the U.S. House post office. Pleaded guilty.

Webster Hubbell - Democrat – Chief Justice of Arkansas State Supreme Court in 1983. Pleaded guilty to federal mail fraud and tax evasion charges – sentenced to 21 months in prison.

Nicholas Mavroules - Democrat – U.S. Representative from Massachusetts from 1979 to 1993. Pleaded guilty to charges of tax fraud and accepting gratuities while in office.

Carl Christopher Perkins - Democrat – Kentucky State House of Representatives from 1981 to 1984 and U.S. Representative from Kentucky from 1985 to 1993. Pleaded guilty to bank fraud in connection with the House banking scandal. Perkins wrote overdrafts totaling about $300,000. Pleaded guilty to charges of filing false statements with the Federal Election Commission and false financial disclosure reports. Sentenced to 21 months in prison.

Richard Hanna - Democrat – U.S. Representative from California from 1963 to 1974. Received payments of about $200,000 from a Korean businessman in what became known as the “Koreagate” influence buying scandal. Pleaded guilty and sentenced to federal prison.

Angelo Errichetti - Democrat – New Jersey State Senator was sentenced to six years in prison and fined $40,000 for his involvement in Abscam.

Daniel Baugh Brewster - Democrat – U.S. Senator from Maryland. Indicted on charges of accepting illegal gratuity while in Senate.

Senator

Christopher J. Dodd and Whitney Harris. The bronze cast bust of Senator Thomas

J. Dodd is by Norman Legassie.

Thomas Dodd father of Christopher Dodd

Like Father Like Son.

Thomas Dodd father of Christopher Dodd

Like Father Like Son.

Thomas Joseph Dodd

- Democrat – U.S. Senator from Connecticut. Censured by the Senate for

financial improprieties, having diverted $116,000 in campaign and testimonial

funds to his own use

Edward Fretwell Prichard, Jr. - Democrat – Delegate to Democratic National Convention from Kentucky. Convicted of vote fraud in federal court in connection with ballot-box stuffing. Served five months in prison.

Jerry Springer - Democrat – Resigned from Cincinnati City Council in 1974 after admitting to paying a prostitute with a personal check, which was found in a police raid on a massage parlor.

Guy Hamilton Jones, Sr. – Democrat -Arkansas State Senate. Convicted on federal tax charges and expelled from the Arkansas Senate.

Daniel Flood - Democrat – U.S. Representative from Pennsylvania from 1945 to 1947, 1949 to 1953 and 1955 to 1980. Pleaded guilty to a conspiracy charge involving payoffs and sentenced to probation.

Otto Kerner, Jr - Democrat - Governor of Illinois from 1961 to 1968. While serving as Governor, he and another official made a gain of over $300,000 in a stock deal. Convicted on 17 counts of bribery, conspiracy, perjury, and related charges. Sentenced to three years in federal prison and fined $50,000.

George Crockett, Jr. – Democrat – U.S. Representative from Michigan. Served four months in federal prison for contempt of court following his defense of a Communist leader on trial for advocating the overthrow of the government.

Cornelius Edward Gallagher - Democrat – U.S. Representative from New Jersey from 1959 to 1973. Indicted on federal charges of income tax evasion, conspiracy, and perjury

Mark B. Jimenez - Democrat fundraiser – sentenced to 27 months in prison on charges of tax evasion and conspiracy to defraud the United States and commit election financing offenses.

Bobby Lee Rush - Democrat – U.S. Representative from Illinois. As a Black Panther, spent six months in prison on a weapons charge.

Bolley ”Bo” Johnson - Democrat – Former Florida House Speaker – received a two-year term for tax evasion.

Roger L. Green - Democrat – Brooklyn Democrat Assemblyman. Pleaded guilty to a misdemeanor for accepting travel reimbursement for trips he did not pay for and was sentenced to fines and probation.

Gloria Davis - Democrat – Bronx assemblywoman. Pleaded guilty to second-degree bribe-taking.

Edward Fretwell Prichard, Jr. - Democrat – Delegate to Democratic National Convention from Kentucky. Convicted of vote fraud in federal court in connection with ballot-box stuffing. Served five months in prison.

Jerry Springer - Democrat – Resigned from Cincinnati City Council in 1974 after admitting to paying a prostitute with a personal check, which was found in a police raid on a massage parlor.

Guy Hamilton Jones, Sr. – Democrat -Arkansas State Senate. Convicted on federal tax charges and expelled from the Arkansas Senate.

Daniel Flood - Democrat – U.S. Representative from Pennsylvania from 1945 to 1947, 1949 to 1953 and 1955 to 1980. Pleaded guilty to a conspiracy charge involving payoffs and sentenced to probation.

Otto Kerner, Jr - Democrat - Governor of Illinois from 1961 to 1968. While serving as Governor, he and another official made a gain of over $300,000 in a stock deal. Convicted on 17 counts of bribery, conspiracy, perjury, and related charges. Sentenced to three years in federal prison and fined $50,000.

George Crockett, Jr. – Democrat – U.S. Representative from Michigan. Served four months in federal prison for contempt of court following his defense of a Communist leader on trial for advocating the overthrow of the government.

Cornelius Edward Gallagher - Democrat – U.S. Representative from New Jersey from 1959 to 1973. Indicted on federal charges of income tax evasion, conspiracy, and perjury

Mark B. Jimenez - Democrat fundraiser – sentenced to 27 months in prison on charges of tax evasion and conspiracy to defraud the United States and commit election financing offenses.

Bobby Lee Rush - Democrat – U.S. Representative from Illinois. As a Black Panther, spent six months in prison on a weapons charge.

Bolley ”Bo” Johnson - Democrat – Former Florida House Speaker – received a two-year term for tax evasion.

Roger L. Green - Democrat – Brooklyn Democrat Assemblyman. Pleaded guilty to a misdemeanor for accepting travel reimbursement for trips he did not pay for and was sentenced to fines and probation.

Gloria Davis - Democrat – Bronx assemblywoman. Pleaded guilty to second-degree bribe-taking.

British

Muslim Brotherhood Created By Freemasonry

Muslim Brotherhood