|

Date: February 22,

2013

Reporting From: Sovereign Valley Farm, Chile

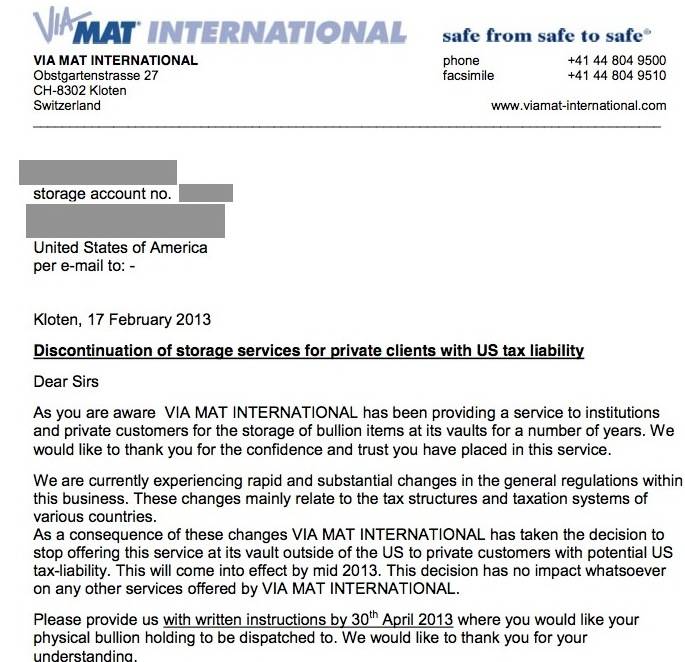

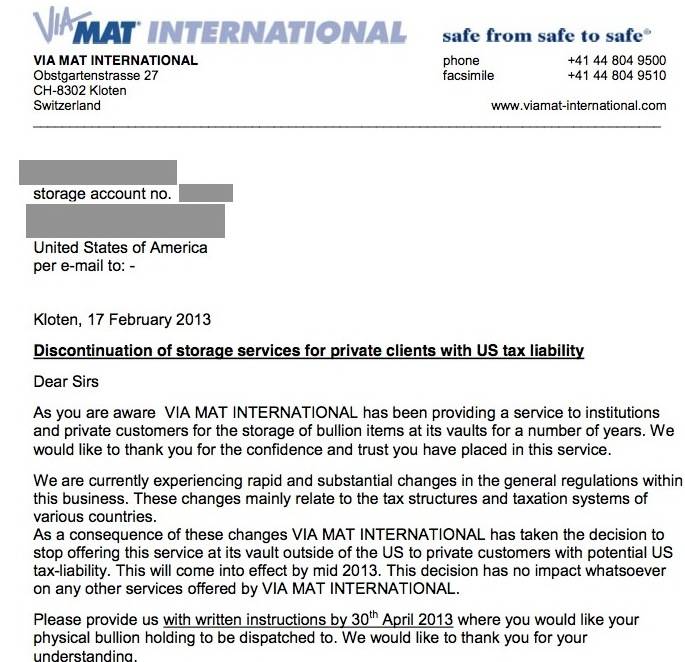

ViaMat, a Swiss

logistics company that has been safeguarding precious metals since 1945,

is literally the gold standard in secure storage. They have vaults from Switzerland to Hong Kong to

Dubai, and they count among their clients some of the largest mining

companies in the world. They know what they're doing. And now they're dumping US citizens. ViaMat does a great deal of business within the United

States. As such, the company is heavily exposed to the insane US

regulatory environment. As an

example, the 2010 Foreign Account Tax Compliance Act turned into more

than 500 pages of regulation! The costs and risks associated with

compliance simply became too much for ViaMat to bear. This matter-of-fact letter from ViaMat management

explains their decision: "We are

currently experiencing rapid and substantial changes in the general

regulations within this business. The changes mainly relate to the tax structures

and taxation systems of various countries. As a consequence of these

changes VIA MAT INTERNATIONAL has taken the decision to stop offering

this service at its vault [sic] outside of the US to private customers

with potential US-tax liability."

This is huge. I can't possibly overstate the potential

ramifications. For one, the big gold depositories

like Gold Money and Bullion Vault ALL use ViaMat as a primary secure

storage provider. So it's only a matter of time before ViaMat's decision

cascades across these other firms. I have

written extensively about this to subscribers of our premium service,

Sovereign Man: Confidential; most gold storage firms are all essentially

different varieties of the exact same product. They are retail marketing

channels that ultimately use ViaMat to store their gold bars. If ViaMat

has US exposure, THEY have US exposure. It's the same risk. Now, if you're in the United States in particular, one

of the most important (and cost effective) steps you can take in

international diversification is to store precious metals overseas. Gold remains the most effective 'anti-currency' out

there, a bet against a corrupt financial system and debt-laden sovereign

governments. But remember-- governments have an unblemished track record

of plundering their citizens' wealth. So if you store your gold in the

US, you might as well ask Barack Obama to keep it under his mattress. If history is any guide, storing gold abroad is

critical. And it's one of those things that you won't be worse off for

doing. The thing is, it's equally critical

to work with a service provider that has no US exposure. There are very few options out there. Again, most of

the big boys use ViaMat, which has heavy US exposure. Or Brinks, which is

a US company. For nearly a year, I've been

encouraging our premium subscribers to store their gold with a

Singapore-based company that has the most advanced, transparent operation

on the planet. They are 100% Singaporean, and their

US regulatory exposure is effectively zero. They're also

one of the only firms on the planet that actually tests the gold it sells

(and stores) through three different methods, including X-ray and

ultrasound. This way you know that your gold is, in fact, gold... and not

tungsten. Best of all, they're launching a new

service to receive your existing gold at their facilities in Singapore.

So if you've just been shut out of ViaMat, or you want to transfer your

gold from another facility that has heavy US exposure, these guys will be

able to do it. They are, without a doubt, the best

solution out there. And Sovereign Man: Confidential members have received

unprecedented discounts and exclusive access to new services offered by

this firm. Storing gold overseas makes sense no

matter what happens. And it's critical to choose a reputable partner with

no US exposure. If you agree with this premise and are serious about

taking action, I'd encourage you to get started right away with a premium membership. Get the actionable intelligence

you need, all backed by our risk-free guarantee. This is huge. I can't possibly overstate the potential

ramifications. For one, the big gold depositories

like Gold Money and Bullion Vault ALL use ViaMat as a primary secure

storage provider. So it's only a matter of time before ViaMat's decision

cascades across these other firms. I have

written extensively about this to subscribers of our premium service,

Sovereign Man: Confidential; most gold storage firms are all essentially

different varieties of the exact same product. They are retail marketing

channels that ultimately use ViaMat to store their gold bars. If ViaMat

has US exposure, THEY have US exposure. It's the same risk. Now, if you're in the United States in particular, one

of the most important (and cost effective) steps you can take in

international diversification is to store precious metals overseas. Gold remains the most effective 'anti-currency' out

there, a bet against a corrupt financial system and debt-laden sovereign

governments. But remember-- governments have an unblemished track record

of plundering their citizens' wealth. So if you store your gold in the

US, you might as well ask Barack Obama to keep it under his mattress. If history is any guide, storing gold abroad is

critical. And it's one of those things that you won't be worse off for

doing. The thing is, it's equally critical

to work with a service provider that has no US exposure. There are very few options out there. Again, most of

the big boys use ViaMat, which has heavy US exposure. Or Brinks, which is

a US company. For nearly a year, I've been

encouraging our premium subscribers to store their gold with a

Singapore-based company that has the most advanced, transparent operation

on the planet. They are 100% Singaporean, and their

US regulatory exposure is effectively zero. They're also

one of the only firms on the planet that actually tests the gold it sells

(and stores) through three different methods, including X-ray and

ultrasound. This way you know that your gold is, in fact, gold... and not

tungsten. Best of all, they're launching a new

service to receive your existing gold at their facilities in Singapore.

So if you've just been shut out of ViaMat, or you want to transfer your

gold from another facility that has heavy US exposure, these guys will be

able to do it. They are, without a doubt, the best

solution out there. And Sovereign Man: Confidential members have received

unprecedented discounts and exclusive access to new services offered by

this firm. Storing gold overseas makes sense no

matter what happens. And it's critical to choose a reputable partner with

no US exposure. If you agree with this premise and are serious about

taking action, I'd encourage you to get started right away with a premium membership. Get the actionable intelligence

you need, all backed by our risk-free guarantee.

Meet the guy who can help you make a

killing in Chilean property

In last month's

edition of Sovereign Man: Confidential Simon

Black provided subscribers with some of the solutions for the looming

agricultural challenges that are affecting food production, as well as an

overview of the best places in the world to own high-quality farmland. On

top of that, a groundbreaking solution was announced to ship your

precious metals to the industry's leading innovator Silver Bullion in Singapore.

This month's issue

includes:

- An interview

with a Chicago-born real-estate investor who lost everything by

betting against a bailed-out U.S. property market in 2008-- then

recouped many times more by investing in

off-the-radar real-estate in Chile. He can help you do

the same.

- An extensive boots on the

ground account from Ecuador. The country is still

incredibly cheap and continues to operate on mañana time. For some

people it ticks all the boxes required.

- Ecuadorian real-estate

can be an incredible value for money. Some of it is literally dirt-cheap. You can buy a

house for only its construction cost, and get acres of very

productive agricultural land for free.

- The extensive coverage of the country also

includes updated information on the various

ways to obtain residency in Ecuador. The barrier to entry

is very low, and, if you want to live there, you can become eligible

for citizenship after only three years.

- This month's issue also includes a thorough overview of buying & selling gold and

silver bullion in Hong Kong. From coins to bars, from

collectibles and jewelry to ingots-- everything is covered,

including storage.

- The lengthy Q&A

section tackles

issues such as traveling with gold internationally, the ins and outs

of taxation on worldwide income, and corporate tax rates and labor

costs in Chile.

|

No comments:

Post a Comment