Ambassador Lee Emil Wanta~

John Ward posted: "EUROZONE BULLIES HOIST BY THEIR OWN FACADE The original Maastricht Treaty set out a very clear debt-to-gdp ceiling of 60% for 'emu' (later the eurozone) as a whole. Today the eurozone reveals a debt to gdp percentage at 93%. More than 50% over the lim"

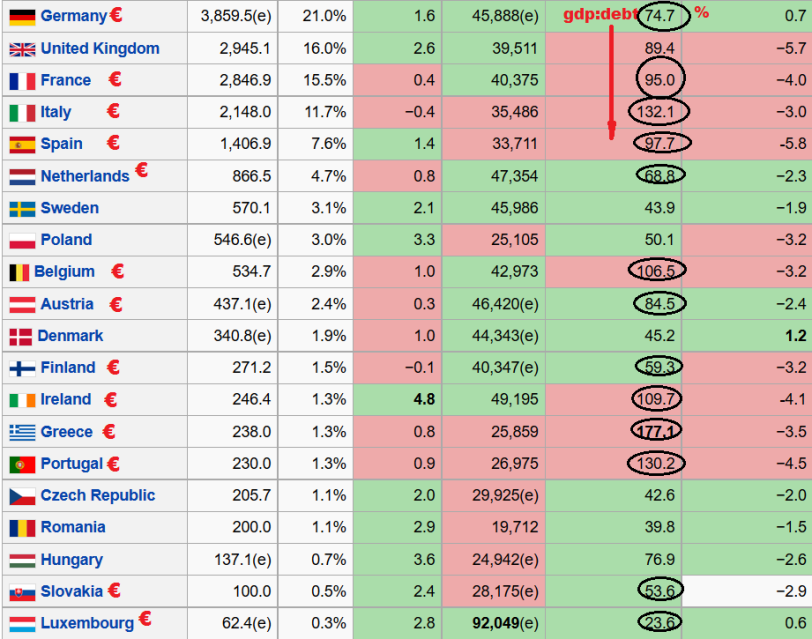

REVEALED….the eurozone deficit sinners whose incompetence makes Greece look like Snow White by comparison

EUROZONE BULLIES HOIST BY THEIR OWN FACADE

EUROZONE BULLIES HOIST BY THEIR OWN FACADE

The original Maastricht Treaty set out a very clear debt-to-gdp ceiling of 60% for ’emu’ (later the eurozone) as a whole.Today the eurozone reveals a debt to gdp percentage at 93%. More than 50% over the limit.

But feast your eyes on this stat: The 2015 Q1 eurozone debt just leapt to €9.4 TRILLION.

Or put another way, more than 26 times bigger than the total Greek debt at 12.45pm today 22nd July 2015 – which stood at just over €357bn.

Take note of these equally irrefutable facts:

1.There are 19 nations in the eurozone, but Greek debt is only one twenty-sixth of it.

2. The eurozone got to this brilliant debt result without the ‘aid’ of any ‘bailouts’. Greece is about to get its third, and during the first two its debt/gdp ratio went UP.

Greece’s debt to gdp ratio when Prime Minister Papandreou formally requested help from the EU on 23rd April 2010 was 129.7%. Today, it stands at 177% of gdp. Some bailout, eh?

There is but one simple conclusion to draw from this, based on the maths outlined above: Greece would’ve been better off without “help” from the eurozone, for the simple reason that those in charge of the eurozone couldn’t hit a barn with a blunderbuss….let alone keep within deficit targets.

Consider: the guideline set for emu States’ debt/gdp ratios was 60%. This chart shows how the main eurozoners fared last year (2014):

Well good gracious me, look at that.

Well good gracious me, look at that.Just 2.3% of the eurozone’s total economy stuck to the Maastricht rules. Those who didn’t included Schäuble’s Germany, Hollande’s France, Dijesslbleom’s Netherlands, Verhofstadt’s Belgium and Rajoy’s Spain.

So for not sticking to the rules as a State bringing 1.3% of gdp to the table, Greece’s independence has been beaten to a pulp by those States who broke all the rules as well…but represent 51.7% of eurozone gdp.

I didn’t include Italy in the 51.7% hypocritical sanctimony sector, because on the whole the Italians have been understanding about the Greek position. But the Mario Draghi whose ECB dramatically worsened Greek debt sustainability via blackmail over the last three weeks hails from Italy…a country whose gdp risk factor is exactly nine times that of Greece.

Mario Draghi is also the QE-er who plans to add €1.1 trillion of eurozone spend on an alleged form of economic stimulation that has now been tried 19 times around the World…and never once stimulated anything beyond stock market share prices and banker bonuses.

Is it time for Yanis Varoufakis to take a job at the IMF….and demand 100% 24/7 access to its offices and books prior to building a class action case against Jean-Claude Trichet for the encouragement of odious debt?

If that seems like a melodramatic question, then think on this: from 2006 to 2009, Greek gdp leapt from €250bn to €350bn, during which Trichet’s ECB actively encouraged the PASOK government to borrow in order to invest in infrastructure….using explosive growth as collateral.

No comments:

Post a Comment